June Jobs Report Shoves 30-Year Mortgage Rates Lower (FHA, VA, USDA & Conv.)

Today's Mortgage Rates Dropping

Current mortgage rates are sharply lower after the June Non-Farm Payrolls report release.

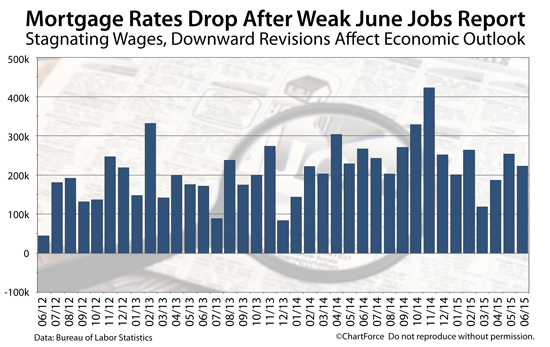

Two hundred twenty-three thousand persons were added to U.S. payrolls last month, and a net negative sixty-thousand person revision was made to the results of the two months prior.

Including the revision, total jobs added last month fell short of Wall Street's expectations. Mortgage rates are reacting positively -- rates are now dropping.

Freddie Mac put this week's average mortgage rate at 4.02% nationwide. This morning's plunge has moved rates down close to one-eighth of a point.

Today's average 30-year rates are closer to 3.875%.

Click for live mortgage rates now.

Mortgage Rates Helped By June Jobs Report

Once monthly, the Bureau of Labor Statistics releases its Non-Farm Payrolls report. More commonly known as the "jobs report", Non-Farm Payrolls details employment in the U.S. economy by sector, and demographic.

The release also includes workforce-related data including employment rates, workforce size, and the number of hours worked per week, on average.

According to the government, the U.S. economy added 223,000 net new jobs in June with nearly half of those jobs coming from professional and business services, and health care. Employment in retail increased 33,000; and, employment in financial activities expanded by 20,000.

The U.S. Unemployment Rate dropped one-tenths of a percentage point to 5.4%, marking the tenth straight month in which the Unemployment Rate read below six percent.

Before the streak, the last time joblessness was less than six percent was July 2008.

Prior to its release, analysts were unsure of what the June Non-Farm Payrolls report would show. Estimates for new job creating ranged from 202,00 to 252,000 net new jobs created. Accounting for the downward revisions to the two prior months, actual job creation fell well short of estimates.

Wage growth was also less-than-expeced with non-government employees receiving no increase in average wage between May and June. Wage growth is just 2 percent per year, and is down from 2.3 percent during the month prior.

Today's mortgage rates are down after the report's release.

Click to see today's live mortgage rates.

Mortgage Rates And Federal Reserve Stimulus

The Non-Farm Payrolls report swings a big stick in mortgage markets. Job growth is linked to economic growth, and economic growth is linked to mortgage rates.

Since late-2012, however, the jobs report-mortgage rates connection has been even tighter.

This is because of the Federal Reserve's theory behind its now-concluded third round of quantitative easing -- a program known as "QE3" -- was that low mortgage rates would help to stimulate job growth and the economy.

The Federal Reserve believes low mortgage rates for the 30-year fixed boost homeownership which boosts consumer spending, construction jobs, and the health of tens of satellite sectors.

QE3 ended in October 2014. During the program's 25-month run, the jobs economy grew by an average of 202,000 jobs per month -- a 44% improvement over the same period prior. The national Unemployment Rate dropped two percentage points.

A strong U.S. economy is typically bad for low rates. This year, however, the reverse has been true.

Worldwide economic uncertainty has pushed investors toward the safety of U.S. government-backed mortgage-backed bonds, a type of trading pattern is known as "safe haven" buying. It's helped to lead mortgage rates lower, in general.

This is among the reasons why mortgage rates are down as Greece faces a default on its debt. There is uncertainty surrounding how Greece's failure will affect the Eurozone and global economy.

As such, Greece is affecting U.S. mortgage rates.

U.S. bonds are rallying after today's weaker-than-expected jobs report, causing mortgage interest rates to fall nationwide. Today's prime mortgage applicants can expect rate in the 3s with low APRs.

VA mortgage rates and FHA mortgage rates are even lower.

Get Today's Mortgage Rates Now

Mortgage rates are falling after the release of the June Non-Farm Payrolls report. It's an excellent time to lock a mortgage rate; or, to consider the refinance of an existing loan. Low rates may not last.

Get a complimentary rate quote now. Compare today's rates at no cost, with no obligation to proceed, and with no social security number required to get started.

Copyright Full Beaker, Inc. 2015

http://themortgagereports.com/17811/non-farm-payrolls-report-jobs-mortgage-rates-june