Exxon's Gamble:

25 Years of Rejecting Shareholder Concerns on Climate Change

Refusing to act on climate resolutions could become a costly mistake, and invite the kind of legal onslaught that cost tobacco companies billions of dollars.

By Elizabeth Douglass, InsideClimate News

At ExxonMobil, the answer is still no.

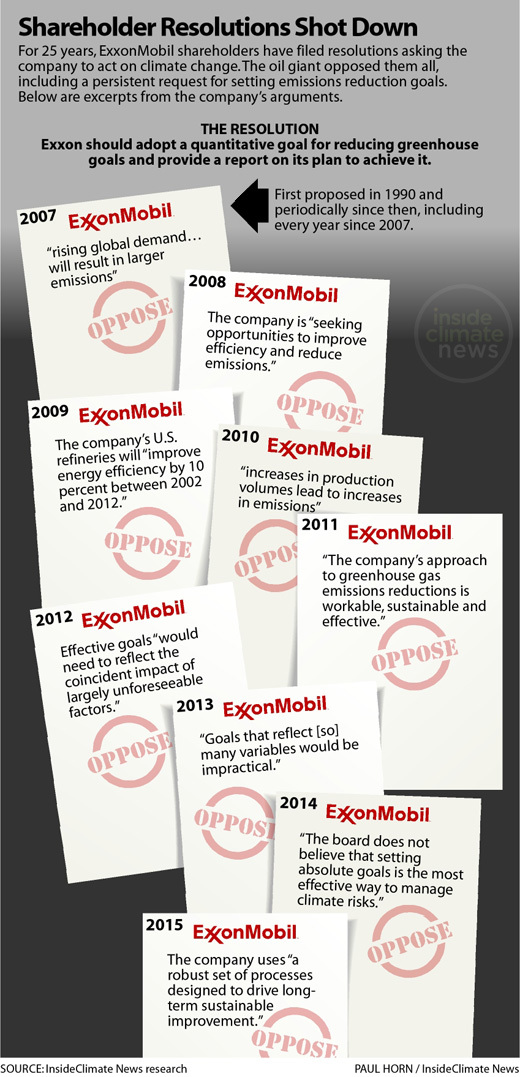

For a quarter-century, stockholders have asked Exxon to confront the threat of climate change in all sorts of ways: by investing in renewable energy, cutting harmful emissions, providing carbon risk assessments and adding a board member with climate expertise. Year after year, the oil giant has said no, rejecting shareholders’ requests and downplaying their concerns long after scientists concluded that unfettered burning of fossil fuels is leading to catastrophic climate change. At Chevron and ConocoPhillips, executives have also routinely opposed climate-related shareholder resolutions.

But Exxon, the biggest and richest of the oil giants, is also the most dug-in. Late last month, it fought off another shareholder request to adopt one of the most basic and widely endorsed climate policies in corporate America—to set company-wide goals to lower greenhouse gas emissions. It’s a proposal Exxon investors have introduced at annual meetings on and off since 1990, and it continues to hit the same wall.

“We have been ringing alarm bells for years saying to the oil companies that the status quo is unsustainable, is dangerous for investors, and in the long term isn’t in the companies’ best interests,” said Timothy Smith, shareholder engagement director at Boston-based Walden Asset Management, a 40-year-old investment firm managing $3 billion in assets. “They’re aware of the trends, but that doesn’t mean they’re changing their business plans. They’re not convinced they should move away from [the oil] business, or even curtail it.”

InsideClimate News investigated 25 years of climate change-related shareholder proposals submitted to Exxon, Chevron and ConocoPhillips. We combed through thousands of pages of documents—proxy statements, annual reports, news accounts—and interviewed dozens of shareholder activists, investment groups and corporate governance experts over the last four months.

Out of more than 400 resolutions examined by ICN, 113 involved climate change, carbon restrictions and the resulting market shifts that could undermine the companies’ profitability and stock value. The total includes only resolutions with global warming as the primary theme or motivation, and not measures about Arctic drilling and hydraulic fracturing, or fracking.

More than one-quarter of the climate-related proposals—30 of them—never got to a vote. They were either withdrawn by their sponsors or excluded from ballots because the companies convinced regulators that they had grounds to do so. The remaining 83 were put to a vote: 40 at Exxon, 22 at Chevron and 21 at ConocoPhillips.

None got enough votes to pass.

Search through the spreadsheet of data compiled by ICN examining 25 years of resolutions

Representatives of Exxon and Chevron declined to answer questions about their responses to climate-related shareholder resolutions and the risk their approach might pose. ConocoPhillips spokesman Daren Beaudo said the company takes shareholder feedback seriously, and is “actively engaged in dialog [with investors] on climate change issues in many ways and on an ongoing basis.”

Fadel Gheit, senior analyst for oil and gas at Oppenheimer & Co., said shareholders are locked in an uphill battle.

“Oil companies should not stick their heads in the sand [on climate change] and pretend they don’t see anything,” said Gheit. “You have a [shareholder] wish list, but at the end of the day, what good is it? It is really not going to change anything.”

Changing major corporations is indeed a tough task, especially for investors who opt for the resolution route. If management opposes a shareholder resolution, the measure usually fails. And even if it wins a majority of votes, companies are free to ignore it because the measures are purely advisory. Still, it’s one of the few ways investors can press for change at publicly traded companies, and it allows them to air the issue in public and at annual general meetings, where their resolutions are put to a vote.

Shareholders with religious convictions were among the first to raise the issue of climate change with oil companies. Faith-based organizations understood the early warnings of climate scientists, and they were disturbed by the potential for human suffering, and moved by the moral imperative of being good stewards of creation.

“We started raising questions with companies around greenhouse gas emissions in 1988, knowing that climate change would be a horror, not just to the planet, but especially to poor people around the planet,” said Sister Patricia Daly, who represents the Roman Catholic Sisters of St. Dominic of Caldwell, N.J. Those climate discussions with oil companies have continued through the years, but it was clear early on that it would take more than talk to persuade Exxon and the others to respond to global warming.

Since then, Daly has submitted so many resolutions that she’s become a fixture at Exxon shareholder gatherings. Daly, 58, recently began a sabbatical from her job as executive director of the Tri-State Coalition for Responsible Investment, but she made an exception for Exxon’s May 27 annual meeting.

Daly, who is clearly at ease with a microphone, introduced her resolution last month, questioned Exxon Chief Executive Rex Tillerson, and worked in a playful jab about being younger than Rev. Michael Crosby, who was there to introduce a separate climate-related resolution.

Daly and Crosby, 75, a Roman Catholic friar at the Province of St. Joseph of the Capuchin Order in Milwaukee, have worked together for years as active participants in the Interfaith Center on Corporate Responsibility (ICCR), a New York group whose members manage more than $100 billion in assets. The pair—once described as “the nun and the friar”—has lost count of the number of oil company meetings they’ve attended. Both continue to highlight the moral case for acting on climate, and are looking forward to Pope Francis driving home that point on June 18, when he delivers his much-anticipated encyclical on the environment.

To strengthen their case for climate action, Daly and others have made a point of linking their moral concern to the financial worries of shareholders, who are weighing the possibility that tough climate policies could eventually force oil companies to leave as much as a third of current global oil reserves in the ground, financially stranded.

That risk has the potential to rock the global economy in the wake of a sudden market reaction to it. What if oil company stocks got walloped, triggering losses in financial markets, pension funds and major international economies? Investors hold more than $3 trillion worth of oil company stock, which accounts for about 4 percent of the value of the world's 2,000 largest publicly traded companies.

While scientific confidence that global warming is man-made and caused largely by fossil fuel burning has reached 95 percent, oil companies have managed to hold that reality at arm’s length. But because their own shareholders are raising these concerns, might the oil companies face retribution for fiduciary negligence should the investors’ warnings come true?

Also from InsideClimate News: Exxon's 25 Years of 'No': Timeline of Resolutions on Climate Change

Some experts say that this is a clear danger. If oil companies continue to ignore the science of global warming, they might be unprepared for damaging climate-related developments, including shifts in oil demand and prices, aggressive carbon emissions limits and other regulations.

If a company suffers losses that could have been avoided or reduced by the steps advocated by shareholders, litigation is a distinct possibility. And if it turns out that the companies actually knew the scale of the risk and deliberately withheld, distorted or ignored that information, they could face the kind of legal onslaught that cost tobacco companies billions of dollars.

“I'm not a lawyer, but I think people need to pay real attention to society’s ability to look back in anger,” said Jeremy Leggett, a London-based author, consultant and founder of Solarcentury, a leading UK solar provider. “I’d be very worried, if I were an oil and gas industry executive, about decisions I made today, given the attention there is to [climate] issues and the things that are at stake for pension holders and all the rest.”

While legal experts say that risk is real for oil companies, they also cautioned that corporate law generally grants company officers broad protections from liability—providing they are not acting illegally.

The process of getting a measure on shareholder ballots is full of pitfalls. Once an investor submits a proposal, companies often respond by challenging the sponsor’s qualifications, citing regulatory exclusions, and picking apart the meaning of individual words or phrases to find justification for disqualifying the measure.

A proposal that makes it through the gantlet faces almost certain defeat if the company recommends a “no” vote. On occasion, negotiations lead the proponents to withdraw the resolution in return for specific company action or further talks.

For the past few years, several climate resolutions at Exxon have won more than a quarter of the shareholder vote, and sometimes nearly a third. The vote count reached a remarkable level of backing for proposals opposed by management, according to Heidi Welsh, executive director at the Sustainable Investments Institute, a Maryland-based nonprofit that provides impartial analysis of social and environmental policy shareholder resolutions.

“If you have 20 percent of your shareholders concerned about something, you may want to pay attention to it,” Welsh said. “These are very big institutional investors. These are the owners of the company.”

In opposing the various resolutions, the oil companies often argue that they are addressing climate change by reducing greenhouse gas emissions, mostly through energy efficiency projects; by limiting leaks of methane and other gases; and by restricting gas burn-off in the field. They sometimes say the steps being proposed by shareholders are counterproductive or contrary to company strategy, and that internal risk assessments already address the possibility of lower oil prices and depressed stock prices from climate-related risks.

Exxon and Chevron, in particular, downplayed the risks by repeatedly citing scientific uncertainties or “gaps” in knowledge regarding how big a role human activity was playing in global warming, and saying there is no need for immediate action until the science is more certain, the financial documents show.

But by the time the first climate shareholder resolution emerged in 1990, research into the “carbon problem” had been underway in industry, government and scientific circles for more than a decade.

“They have their scientists, and I don’t think there’s anything we know that they haven’t known well before us,” said Crosby, the friar. “We don’t have any smoking gun, but the data would indicate that they weren’t forthcoming.”

Over the years, the three oil companies have met with Crosby and other groups behind many of the climate resolutions. They have provided some requested reports, explained in-house efforts to limit emissions and energy use, and unlike Exxon, Chevron and ConocoPhillips began setting annual targets for reducing greenhouse gas emissions.

“It seems like they keep fighting just at the level of what is not laughable from a reasonable person’s perspective,” said Rob Berridge, director of shareholder engagement at Boston-based Ceres, one of the leading investor advocates for sustainable business. “Ten years ago, they could get away with denying the science, but now they realize they can’t get away with that, so they keep taking the smallest steps possible.”

Over the 25-year period reviewed by ICN, Chevron’s shareholder resolutions on global warming asked the company to report on renewable energy efforts, add climate competency to the board and assess a broad range of climate-related financial risks. The resolution to include a board member with climate change knowledge won at least 20 percent of the vote at the past six annual meetings.

The California-based company hasn’t done any of those things. Yet it was the first U.S. oil company to work out how to quantify its greenhouse gas emissions and then set goals for reducing them, according to Daly of the Sisters of St. Dominic. It did so in 2002, and then shared the process with other oil companies.

It also was the only U.S. oil major to do more than dabble in energy not derived from fossil fuels. For a time, Chevron was part of a small group of oil companies—including BP, Shell and Total—that were publicly touting forays into renewable and alternative energy. All of them except Total subsequently retrenched, shutting down and selling off the projects, and then embracing the industry’s standard talking points once again. Chevron remains a member of many of the same anti-climate policy lobbying groups as Exxon, including the American Legislative Exchange Council (ALEC) and the U.S. Chamber of Commerce.

Even so, Daly said she believes the company has “come a long way. When we first started talking with Chevron, basically, the [climate] plan on the table was planting trees,” she said.

At Chevron’s May 27 annual meeting, a new measure sought to slow Chevron’s spending on the most expensive and riskiest exploration projects and to redirect that cash to shareholders through higher dividends. The backers said it would be a better use of funds, since some of Chevron’s costliest projects could get stranded under certain climate change scenarios. The resolution won 4 percent of the vote.

Of the three companies ICN reviewed, ConocoPhillips offers the most accessible public disclosure on its website, with easy-to-read information on methane and carbon dioxide emissions, pollutants associated with its operations, emission reduction goals, political contributions and the names of trade groups and organizations to which it pays more than $50,000 in annual membership fees.

ConocoPhillips has also taken three steps that are still on shareholder wish lists for most oil companies: It has added a climate expert to its board; dropped its membership in ALEC, a group that has been pushing states to roll back renewable energy programs; and publicly disclosed how it assesses the company’s resilience and asset values in a carbon-constrained economy.

“We understand the importance of these issues…and while uncertainties remain, we continue to manage greenhouse gas emissions in our operations and to integrate climate change related activities and goals into our business planning,” said Beaudo, the ConocoPhillips spokesman.

The company, however, has retained its memberships in the U.S. Chamber of Commerce, Western States Petroleum Association and other groups that lobby against climate-related public policies. In addition, ConocoPhillips was part of last year’s campaign by the oil industry to exempt gasoline and diesel from California’s cap-and-trade system.

Gretchen Goldman, lead analyst for science and democracy at the Union of Concerned Scientists, said such contradictions are common, making it difficult to determine which companies are genuinely reversing their stance on global warming.

“We see these wonderful flowery statements and a really great website that talks about climate change science,” Goldman said. “But if their lobbying strategies aren't following suit, then we don’t have a company that's walking the walk on climate change. And there's a lot of that.”

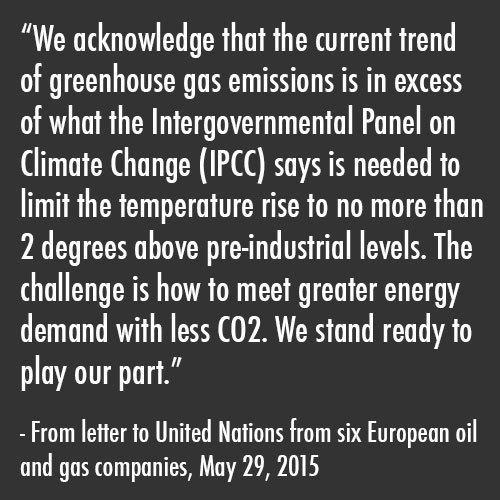

Recently, European oil companies have made an effort to distance themselves from the U.S. industry’s approach to climate change—both in public and with their shareholders.

On May 29, six European oil and gas companies wrote to the United Nations to declare their support for policies that would put a price on the use of carbon-based energy, such as oil, natural gas and coal. The well-publicized move was viewed by some as a bid to position coal as the primary culprit in the climate crisis. Putting a price on carbon would involve either a tax or a trading system for carbon credits.

On the shareholder front, BP, Royal Dutch Shell and Statoil recently took an unexpected step by publicly supporting shareholder resolutions seeking broad disclosure of how the companies are managing climate change risks. One of the measures won 98 percent approval at BP’s annual meeting April 16. In May, Shell and Statoil shareholders passed similar measures with 99 percent of the vote.

Exxon seems intent on taking the opposite path. This year, the oil giant didn’t merely maintain its objections to a popular and long-running greenhouse gas proposal—it appears to have actively campaigned against it.

That resolution, championed for years by Daly, the nun, won just 9.6 percent of the vote at last month’s meeting, after it had collected votes between 20 and 30 percent the previous eight years. The low level of support means the proposal will be barred from Exxon ballots for three years.

The result was especially disheartening because a public campaign for the resolution by the Interfaith Center on Corporate Responsibility and Daly's Tri-State Coalition for Responsible Investment had secured more than 19 million “yes” votes from groups that manage $1 trillion in assets.

“We were clearly disappointed. I think the vote reflected a good bit of money and effort by the company to reach out to the proxy voting services,” Daly said. One of those services, Institutional Shareholder Services, advised its clients to vote against the greenhouse gas resolution this year, reversing years of recommending “yes” votes.

“They worked very hard against us,” Daly said of Exxon. “Of course there’s frustration. But we’re not going away.”

Naveena Sadasivam contributed to this report.