By

Susan Boskey

By

Susan BoskeyTo seek a high credit score or a life without debt, that is the question. When seeking a high credit score, you must make sure to have a perfect-payment history, stability on your job, an expanding credit history, and available credit you carefully use and repay. To get started, financial planners will recommend that you obtain a low-limit (like $500) secured credit card, use it, and pay it all back. The goal is to gain a high score to have easy access to credit for a car or mortgage. That said, financial planners are unlikely to ever tell you how to live credit-free and avoid the misery of mounting debt.

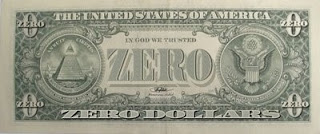

Why donít they tell you? From global to national to local, all money is derived from a debt-based monetary system and is, itself, a debt instrument (read: Federal Reserve Note on a dollar bill). Most financial planners are well-meaning but have not been educated on these facts and, therefore, cannot advise you accordingly.

The untold truth about money is what any online inflation calculator can tell you; $1.00 is now worth less than .o4 cents and keeps losing value due to how the system works. What this means to you is that the cost of living has skyrocketed and outpaces earning. Credit rushes in to fill the gap and you are the one stuck with the bill.

http://www.activistpost.com/2015/06/your-credit-score-or-life-without-debt.html