The Labor Department "meaningfully softened" the rule, Morgan

Stanley insurance analysts said, characterizing it as "good news for

those companies impacted."

Wednesday's announcement caps a fierce, six-year battle involving

the Labor Department, Wall Street and many U.S. lawmakers.

The Department received more than 3,000 letters about the rule and

took part in more than 100 meetings. It first issued a proposal in

2010 but rescinded it the following year in response to an enormous

industry backlash. A second proposal issued last year also faced

criticism.

Firms have said the rule would raise compliance costs, and therefore

fees, and force them to get rid of Main Street clients and small

businesses that offer 401(k) plans.

The Labor Department said complying with the rule would cost the

brokerage industry up to $31.5 billion over the next decade but

produce even bigger gains for investors.

Some lawmakers said the Labor Department should hold off until the

U.S. Securities and Exchange Commission finalizes its own fiduciary

rule, which it has been crafting for years. SEC Commissioner Michael

Piwowar expressed opposition to the final rule on Wednesday.

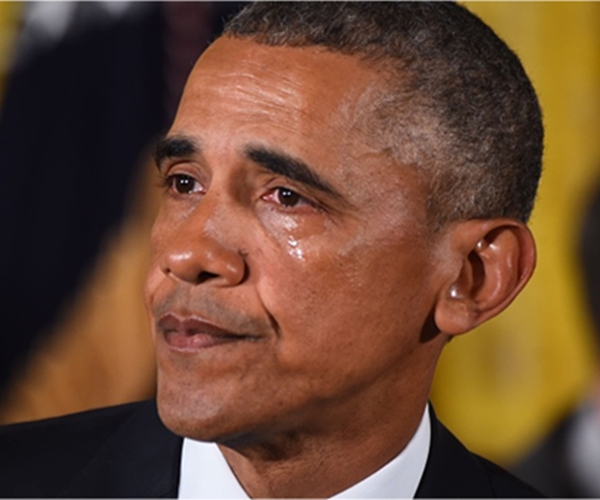

PRIORITY FOR OBAMA

President Barack Obama had made a new fiduciary rule a priority for

his administration. In a speech at AARP headquarters last year, he

said Wall Street brokers were bilking retirees out of billions of

dollars in savings through hidden fees and that he intended to

ensure the industry put clients' interests first.

"If expecting retirement advisers to act in their clients' best

interest sounds like it's pretty obvious – and it's pretty obviously

the right thing to do – it's because it is," Jeff Zients, director

of the White House's National Economic Council, said in a call with

reporters.

Although the final rule did include the best-interest provision, it

made plenty of concessions.

For example, the draft listed types of assets that advisers could

recommend to steer retail investors away from certain high-risk

products. The final version eliminates that list, mostly in response

to the financial industry's concerns, the Labor Department said.

Brokerages and lawmakers were also concerned about an earlier

requirement that brokers sign contracts with clients at initial

meetings. The document was to include investment projections, fee

disclosures and other detailed information.

The contracts are required in the final rule, but can be as short as

a paragraph, signed later and tucked into paperwork that customers

sign when opening new accounts, Labor Secretary Thomas Perez said.

The final version also loosened guidelines on pay, allowing advisers

to collect "common types of compensation," such as commissions and

revenue-sharing, where brokerages receive payments from mutual-fund

companies to help promote products.

Obama Weakens Retirement Advice Rule, Caving to Industry Pressure

Thursday, 07 Apr 2016

A new U.S. rule aimed at protecting retirement savers from profit-hungry brokers turned out to be much weaker than an initial proposal after the Obama administration bowed to pressure from the financial services industry.

The rule, announced by the Department of Labor on Wednesday, sets a so-called fiduciary standard for financial brokers who sell retirement products, requiring them to put clients' best interests ahead of their bottom line. The language is tougher than an existing rule that only requires brokers to ensure products are "suitable."

However, the Labor Department did compromise with the industry on a range of provisions. Unlike the draft proposal, the final rule does not restrict brokers from pushing proprietary products, splitting revenue with creators of funds they promote, or recommending risky, high-fee investments in alternative assets and certain annuities.

Brokers also got more time to implement the changes, which they said were costly and difficult. The rule will now take full effect on Jan. 1, 2018, compared with an eight-month compliance deadline in the Labor Department's initial proposal.

Nonetheless, brokers will now be covered by a fiduciary standard, said Massachusetts Senator Elizabeth Warren, a consumer advocate who helped shine a national spotlight on the proposal last year.

"There's no doubt there is some risk," Warren, a Democrat, said in an interview. "On the other hand, the Department of Labor was not looking to put all proprietary products out of business," Warren said.

The goal is to make sure there is "adequate regulation," said Warren, adding that she now believes there will be.

Democratic presidential front-runner Hillary Clinton issued a statement in support of the new rule, saying it will "stop Wall Street from ripping off families" and "save seniors billions."

However, Knut Rostad, an investor advocate who chairs the Institute for the Fiduciary Standard, said he was disappointed that the final rule was not tougher, calling it "a major defeat for investors, period."

Some leading Republican lawmakers also expressed continued opposition to the rule, saying it would prevent low- and middle-income Americans from saving for retirement or getting access to advice.

Several major brokerage firms said they needed time to review the implications, but that they generally supported the idea of a "best interest" rule. Industry trade groups reiterated concerns that the rule could have negative effects.

But several Wall Street analysts who cover brokerages, insurers and mutual fund companies affected by the rule said it turned out to be much less onerous than initially feared. Shares of brokerage, mutual fund and life insurance companies showed little reaction to the news.

![]()

© Thomson Reuters 2016 All rights reserved