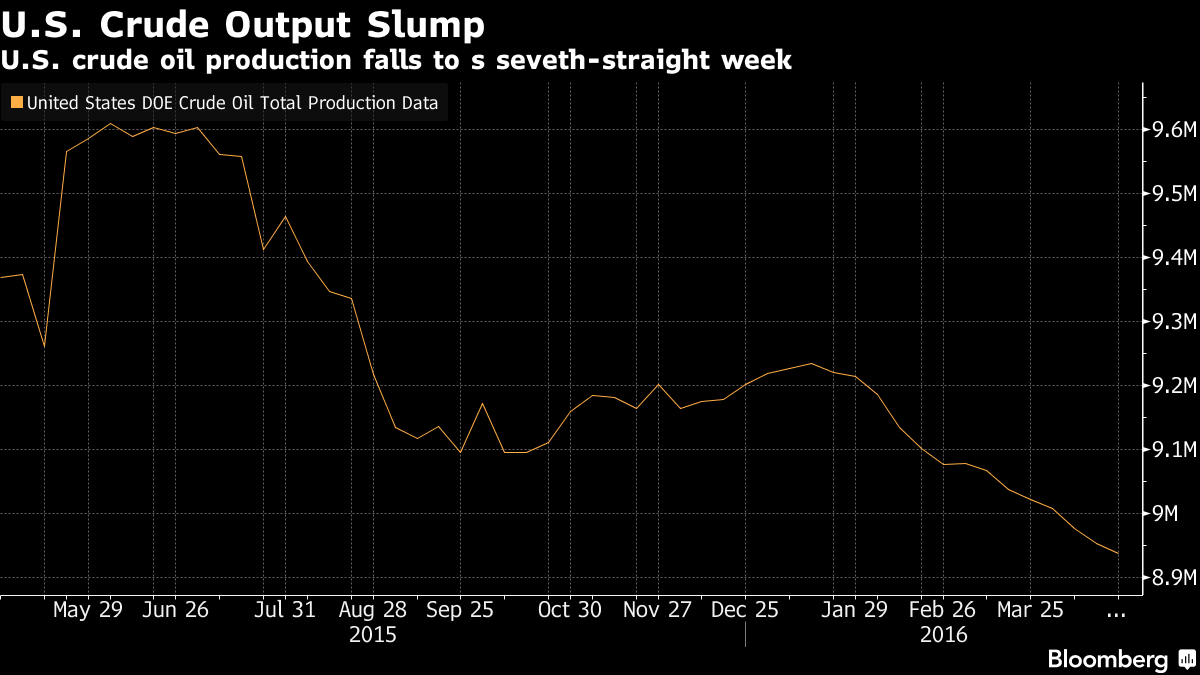

Oil Climbs Above $45 Amid U.S. Crude Output Drop, Fed Statement

U.S. crude output slipped to 8.94 million barrels a day: EIA

Inventories top 540 million barrels for first time since 1929

Oil closed above $45 a barrel in New York for the first time since November after U.S. crude output dropped and Federal Reserve policy makers signaled they’re open to raising interest rates in June.

Crude production fell to 8.94 million barrels a day last week, the least since October 2014, Energy Information Administration data show. Futures fell on the initial release of the report because it showed crude inventories rose. Oil extended gains after the Federal Open Market Committee omitted previous language that “global economic and financial developments continue to pose risks,” instead saying officials will “closely monitor” such developments.

"We are focused on U.S. production, which was down again," said Cavan Yie, senior equity analyst at Manulife Asset Management Ltd. in Toronto. "Production is down about 650,000 barrels from the peak, and it’s going to keep dropping because nobody is spending any money to drill new wells."

Oil has rebounded since slumping to the lowest level since 2003 in February, amid signs the global surplus will ease as U.S. production declines. The World Bank boosted its forecast for oil prices this year, projecting that U.S. output cuts will steepen in the second half of 2016. Markets may rebalance by the end of the year, BP Plc Chief Executive Officer Bob Dudley said Tuesday as the company reported a surprise first-quarter profit.

West Texas Intermediate oil for June delivery increased $1.29, or 2.9 percent, to settle at $45.33 a barrel on the New York Mercantile Exchange. It’s the highest close since Nov. 4.

Global Risk

Brent for June settlement rose $1.44, or 3.1 percent, to $47.18 a barrel on the London-based ICE Futures Europe exchange. It’s the highest close since Nov. 10. The global benchmark ended the session at a $1.85 premium to WTI.

"The market seems to be focused on the change in Fed language about global risk," said Bob Yawger, director of the futures division at Mizuho Securities USA in New York. "They are no longer warning of possible risks, which is being taken as a positive sign."

The Fed left its benchmark interest rate unchanged. Policy makers are weighing when to raise rates again after the first increase in almost a decade in December. Central-bank optimism about economic growth and inflation may renew policy divergence between a tightening Fed and central banks overseas.

Bull Market

"We’re in a bull market," said Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $3.6 billion. "Every pullback is being seen as a buying opportunity, which is what happens."

Nationwide crude supplies rose 2 million barrels to 540.6 million last week, the most since 1929, EIA data show. Supplies at Cushing, Oklahoma, the delivery point for WTI and the nation’s biggest oil-storage hub, climbed by 1.75 million barrels.

"Demand should exceed supply by the second half of the year at a minimum," said Rob Thummel, a managing director and portfolio manager at Tortoise Capital Advisors LLC who helps manage $13 billion. "There’s little margin for error, so any disruption could have a major impact."

Refineries reduced operating rates by 1.3 percentage points to 88.1 percent of capacity. U.S. refiners typically increase utilization in April as they finish maintenance before the summer peak driving season.

Gasoline inventories rose 1.61 million barrels last week, while supplies of distillate fuel, a category that includes diesel and heating oil, fell 1.7 million.

Surging Demand

U.S. gasoline consumption, averaged over four weeks, was up 5.6 percent from a year earlier at 9.4 million barrels a day through April 22, EIA data show. Americans drove 232.2 billion vehicle miles in February, up 5.6 percent from a year earlier, Transportation Department data show.

Gasoline futures for May delivery increased 1 percent to $1.5808 a gallon, the highest settlement since August. May diesel climbed 3.5 percent to $1.3795, the highest close since November.

The average price of regular gasoline at the pump nationwide was $2.152 a gallon on Tuesday, down 15 percent from a year earlier, according to data from Heathrow, Florida-based AAA, a national federation of motor clubs.

"All signals point to strong demand," Thummel said. "Gasoline prices are lower than a year ago as we approach the driving season. Last year low prices boosted demand and there’s no reason to expect this year to be any different."

Oil-market news:

- Authorities in eastern Libya vowed to export more crude oil soon, two days after shipping their first cargo in defiance of a national unity government based in Tripoli and in spite of a UN official’s condemnation of such “illicit” sales.

- Statoil ASA, Norway’s biggest oil company, unexpectedly posted a profit in the first quarter as cost cutting helped offset the lowest crude prices in almost 12 years.

- Total SA posted first-quarter profit that beat analysts’ estimates as cost cuts, rising output and resilient refining earnings helped the company offset low crude prices.

©2016 Bloomberg L.P. All Rights Reserved

[Editor: It is our opinion that the reduction of US Oil Production is what the price reduction this past year is all about. ]