Battery Storage Systems Shine With Solar Deployments

2/19/2016

Homeowners, who may soon store energy from solar cells instead of selling back to the grid, should select storage components wisely.

The renewable energy storage market is on a tear, driven by lower-cost batteries, incentivized solar installations, a desire for energy independence, and the need for smart-grid stability and lower overall utility costs.

While current solar energy tax incentives start to dissipate in 2016, a bid to extend those incentives to 2020 has just passed Congress and has reignited the solar industry, with a knock-on effect for battery-based energy storage systems.

This surge around energy storage systems (ESS) in general, and renewable energy storage (RES) in particular, has created enormous opportunities for designers of power conversion architectures and inverters, especially for home applications. Even Tesla has gotten involved, announcing its Powerwall, a $3,500, 10-kWh storage system for the home, business and utilities.

However, designers beware: choose the wrong components and you may delay your design’s time to market, or worse still, seriously injure the unsuspecting homeowner.

Battery storage: Hawaii beats California

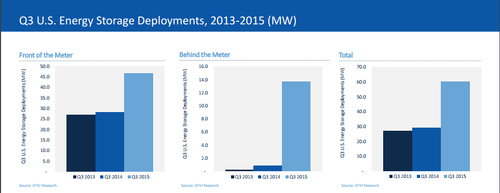

According to GTM Research, 60.3 megawatts (MW) of energy storage were

deployed in Q3 2015, twice that of Q3 2014 – and a 46% increase from Q2

2015. However, it is the “behind the meter” market, including

residential and commercial, that is shining through, growing to over 15

times that of Q3 2014.

Click here for larger image

Regionally, Hawaii took the lead in residential ESS deployments, surpassing California for the first time, which came in third. GTM combined the other five regions it monitors into second place.

And the future only gets brighter. GTM predicts that the U.S. energy storage market will surpass 1 gigawatt (GW) in 2020, translating to a dollar growth from $381 million in 2015 to $2 billion by 2020, with the behind-the-meter sector increasing its overall portion to 59% of the total market.

Solar energy flares

That Hawaii would outshine California in energy storage

deployments comes as no surprise to Brett S. Simon, Energy Storage

analyst at GTM. “Hawaii’s electricity prices are high, and it already

has a high level of residential PV [photovoltaic] deployments,” he said.

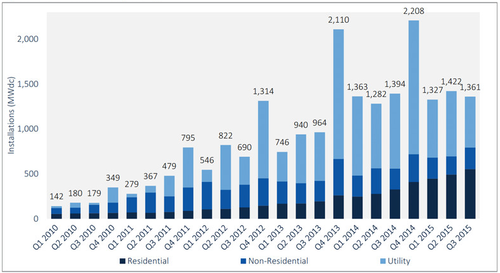

The connection of ESSs to photovoltaic deployment cannot be ignored, particularly with regard to residential applications, where solar deployments are increasing at a phenomenal rate (Figure 2). This increase has technological as well as financial drivers.

Click here for larger image

Technologically, the efficiency of solar cells continues to increase and module costs continue to fall, to the point that it has increasingly become a viable option in many developed regions as well as an alternative to diesel in regions such as Africa.

That said, solar’s cost parity with conventional power sources remains a discussion shrouded in controversy, nuances, biases and misinformation, much of it due to subsidization of both solar cell manufacturing and deployments.

As mentioned above, federal investment tax credits (ITCs) have encouraged and subsidized many residential deployments of solar power. In fact, GTM based its 2016 projections on the likelihood that those ITCs would start expiring at the end of next year, driving somewhat of a “gold rush”.

“In 2016, developers will have a laser-like focus on project build-out in order to qualify for the 30% federal Investment Tax Credit, which is scheduled to step down to 10% for utility, commercial, and third-party-owned residential PV, and to expire altogether for direct-owned residential PV on January 1, 2017.”

—The quarterly SEIA/GTM Research U.S. Solar Market Insight report (Q3, 2015).

But not so fast: The effect of those ITCs expiring would ripple across the entire renewable energy and storage industry. So much so, that in December 2015, Congress extended the ITCs beyond the original expiration date of 2016.

The deal would call for a five-year renewal of the ITC in exchange for lifting the ban on U.S. oil exports. By the end of day, battered solar stock prices had rallied, with SolarCity’s stock price alone soaring by more than a third.

In response to the rule change, IHS Research, which initially had projected solar deployment in the U.S. to approach 17 GW in 2016, before falling to 6.5 GW in 2017, has revised its 2017 figure upward, dramatically, to between 13 and 16 GW. It expects it to peak in 2020 and 2023, based on the new ITC rules.

The U.S. isn’t alone in expanding PV deployments. "Solar power could grow by 80% in Europe by 2020,” said James Watson, CEO of SolarPower Europe, commenting on a research firm that released its “Global Market Outlook for Solar Power 2015-2019” report in June of 2014.

While 40 GW had been deployed globally in 2014, the report predicted that 540 GW could be deployed by 2019. All this bodes well for energy storage, though lithium-ion (Li-ion) may not be the beneficiary.

A recent report by Navigant Research made the point that, “Input costs, some safety issues, and materials scarcity all make that chemistry’s [Li-ion] current grasp on the leadership title relatively weak, and these challenges leave it vulnerable to new chemistries that solve some or all of those problems.”

Those advanced storage options include ultracapacitors (not a battery chemistry, but counted as an advanced storage mechanism for the purposes of the report) as well as battery chemistries such as lithium sulfur (LiS), magnesium ion (Mg-ion), solid electrolyte, next-generation flow and metal-air. Navigant expects global deployments of next-generation technologies for energy storage to increase from near zero this year, to $9.4 billion by 2023. The bulk of that will come from Europe and Asia. Overall battery demand will increase from 66.2 GWh in 2014 to over 225.3 GWh in 2023.

Energy storage rising with renewables

Adding some form of energy storage to a renewable energy

source, particularly solar, is one of the main drivers of ESS

deployment, according to Tee Chun Keong, a product marketing manager at

Avago Technologies, Inc. Avago is a major supplier of components to the

power conversion and isolation protection market.

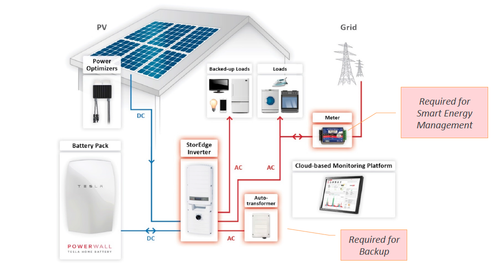

Click here for larger image

Traditionally, adding a solar panel came with the assumption that any excess power generated by the solar cells and not used by the homeowner would be sold back to the utility.

“But now the extra energy can be used to charge the battery,” said Tee , “So in the evenings, when energy consumption is highest and there is no sun, it [the home] really relies on the backup battery to supply electricity, so you're less reliant on the grid and are more self sufficient.”

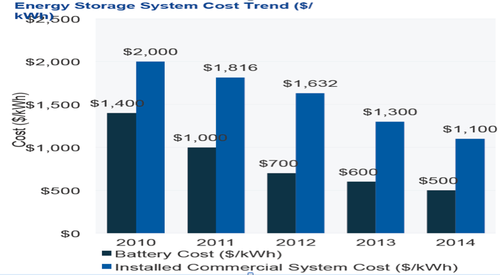

That batteries themselves are coming down in cost is also a big factor in the adoption of battery ESS (BESS) (Figure 4.) From 2010 to 2014, battery cost per kilowatt hour (KWh) dropped from $1,400 to $500, according to GTM Research. During the same period, the installed commercial system cost dropped from $2,000 to $1,100.

Click here for larger image

If you take the Tesla example above and do some quick math ($3,500/10 KWh) Tesla has brought battery cost down even further, to $350/kWh, while making them “prettier” and more practical by allowing them to be hung on a wall instead of taking up floor space.

If falling costs, ease of use, and more aesthetically pleasing designs weren’t enough incentive, David Hague, senior director of marketing and technology partnerships at Gehrlicher Solar, made his own list of 22 reasons for energy storage, mostly echoing the reasons given here, but with more device and market specificity.

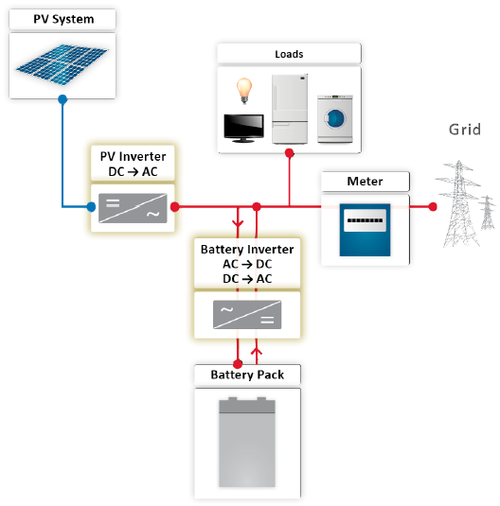

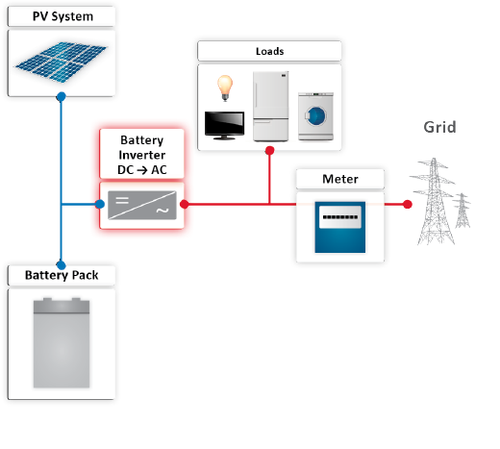

New architectures, same dangers

This trend toward including ESS with solar deployments has had

an interesting effect on architecture and converter design approaches

(Figure 4). When battery storage was a rarity, the battery was charged

by tapping the mains supply, via an AC-DC converter. When the AC went

down, the battery would switch in via a DC-to-AC inverter.

Click here for larger image

Figure 5. When battery-based storage was an afterthought, power to charge the battery was tapped off the home AC supply and was relatively inefficient due to multiple conversions (a). New architectures include PV monitoring and direct dc coupling improve efficiency (b), with options to also integrate the inverter and metering for grid-ties. (Images Courtesy of SolarEdge)

Click here for larger image

All the parts had to be bought separately, battery, inverter, and metering, while multiple voltage conversions led to unnecessary losses and overall inefficiencies. Even the metering wasn’t too exciting.

Now, that’s changed. A full system can be integrated, including the PV monitoring and DC-DC conversion to charge the battery, as well as the inverter. Metering has advanced to ZigBee or other wireless technologies to provide either computer or app-based monitoring of the entire system.

Of course, it’s still not a simple thing to optimize PV conversion. Maximum power point tracking (MPPT) must still be performed to ensure the varying PV energy is captured and transferred to the battery with minimal power losses, regardless of sun strength. This involves stabilizing the PV voltage, using a capacitor, for example, and then ensuring that the charging voltage is efficiently dropped to match battery chemistry. This also requires some sort of isolated communication to the battery from the PV, or to the battery and the rest of the home power loads.

Also, inverters have an IGBT or MOSFET switch in a half-bridge topology, with four to six switches inside. To minimize switching losses, those IGBTs or MOSFETS need to be switched quickly and with precise timing. This means the designer of the system needs to make sure the driver can supply enough gate current to turn the IGBT on quickly, while also making sure it can switch fast enough between different stages so the next stage turns on as quickly as previous one turns off.

When converting to charge the battery, the charging voltage must also be switched at between 100 to 200 KHz, again putting the onus on the designer to pick a fast, isolated device. Other isolation device functionalities include gate driving, current/voltage sensing and digital communication.

Efficiency, cost, and ease of use are all critical factors at the system level, but above all, safety is the biggest priority, and is one feature that hasn’t changed, hence the emphasis on isolation in the standards that govern this topic, including, “IEC 62109-1 Safety of Power Converter for Photovoltaic Power Systems.”

While both digital isolators and optocouplers can meet many of the other requirements, ensuring voltage isolation from device to user requires special attention. In a PV application, they must be capable of withstanding more than 400 Vdc and up to 50 A of current to charge the battery. Also, the voltage from the solar cell can be in excess of 400 to 600 V, or even up to 1000 Vdc. In the case of Tesla, its Powerwall requires 450 V and its battery current capability is almost 10 A.

There are two aspects to the device choice at this stage: ensuring user safety and also getting a design through regulatory requirements. While both digital isolators and optocouplers can handle almost all the requirements in terms of functionality, speed as well as creepage and clearance, only optocouplers are certified to IEC 607475 and voltages up to 1,400 Vdc (operating) with reinforced insulation.

In the real world, this means a design can move through the regulatory environment a lot more quickly as optocouplers have been performing high-voltage isolation for over 30 years and go beyond basic requirements. Also, if the device fails, it fails safe, so the user is never in any danger.

Avago’s Tee elaborates upon this in the video below, as well as some new features and functionality Avago is offering in products that are just now being announced, such as the ACPL-335J. This is a 2.5-A MOSFET gate drive optocoupler with integrated over current sensing, active Miller clamping, fault and UVLO status feedback, suitable for battery charging applications.

References:

- US Energy Storage Monitor: Q3 2015 Executive Summary

- Energy Storage Association, GTM Research, https://www.greentechmedia.com/research/subscription/u.s.-energy-storage-monitor

- SEIA/GTM Research "U.S. Solar Market Insight report", http://www.seia.org/research-resources/solar-market-insight-2015-q3

- "Re-considering the Economics of Photovoltaic Power", http://az2112.com/assets/energy-bnef_re_considering_the_economics_of_photovoltaic_power_a_co_authored_white.pdf

- Upcoming vote on solar ITC extension changes US solar picture, http://renewables.seenews.com/news/upcoming-vote-on-solar-itc-extension-changes-us-solar-picture-505908

- 22 Reasons for storage (Hague), http://gehrlichersolar.us/22-reasons-for-storage-3/

- SolarEdge "StorEdge datasheet", http://www.solaredge.us/files/pdfs/products/StorEdge/se_storedge_inverter_datasheet_na.pdf

- GreenTech Media/SolarEdge Webinar: StorEdge: Optimized Inverter Solutions for Home Energy Storage

- "Global Market Outlook for Solar Power 2015-2019", http://resources.solarbusinesshub.com/solar-industry-reports/item/global-market-outlook-for-solar-power-2015-2019#sthash.YIcuCcJE.dpuf

- Next-Generation Advanced Batteries, http://www.navigantresearch.com/wp-assets/uploads/2014/06/NGAB-14-Executive-Summary.pdf

http://www.eetimes.com/author.asp?section_id=36&doc_id=1328977