Freddie Mac: Mortgage Rates On Massive Win Streak

Mortgage Rates On A Winning Streak

After a (very) rough December, mortgage rates have resumed their winning ways.

For the second straight week, government agency Freddie Mac is reporting a drop in 30-year conventional fixed rate mortgage rates; and, rates for the 15-year fixed rate mortgage and 5-year adjustable rate mortgage (ARM) are lower, too.

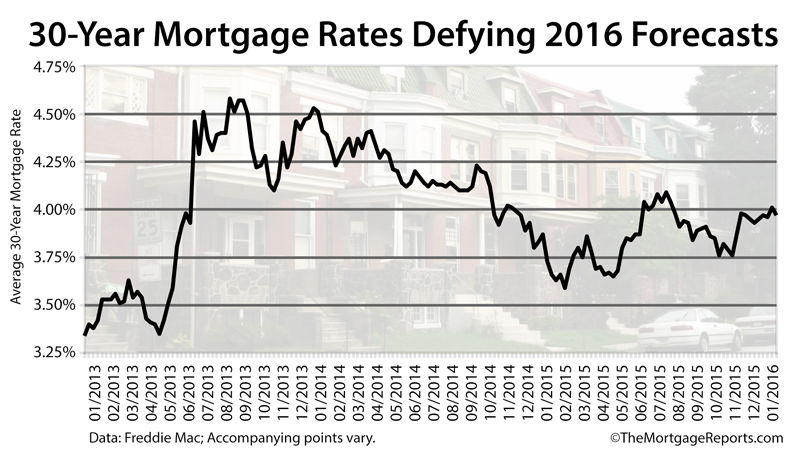

Rates have now improved through 12 of the last 14 days, which defies analyst forecasts for 2016 mortgage rates. Experts predicted mortgage rates approaching five percent soon. We're already back in the 3s.

Even better, the win streak may just be getting started.

Global economic weakness and a plunge in China's equities market have sparked a bout of safe-haven buying which will likely fuel MBS market gains through the end of Q1 2016, at least.

If you missed your chance to refinance late last year, or are thinking about buying a home, U.S. mortgage rates are currently in your favor.

Click to see today's rates (Jan 18th, 2016)Freddie Mac Puts Rates At 3.92% (But They're Much Lower)

The average 30-year conventional mortgage rate dropped 5 basis points (0.05%) last week, landing at 3.92%, according to Freddie Mac.

The Freddie Mac rate, which is based on a survey of 125 U.S. lenders, is an average of the interest rates made available to prime mortgage borrowers where a "prime borrower" is one with credit scores of at least 740; a verifiable source of income; and who is requested purchase loan with at least twenty percent down.

To lock the Freddie Mac reported rate requires an average of 0.6 discount points.

Discount points are one-time loan fees paid at the time of closing. Each whole discount point carries a cost of one percent of your loan size such that this week's average discount point cost of 0.6 would cost a San Francisco homeowner $3,753, assuming a loan at the local conforming loan limit of $625,500.

However, if you're shopping for a loan today, for a purchase or refinance, you'll notice that today's live mortgage rates may be a bit lower that what Freddie Mac reports.

The discrepancy between Freddie Mac's reported rates and today's "real" mortgage rates is a function of timing. Freddie Mac's survey concludes early in the week, and this week's mortgage rates made large improvements late in the week, after the close of the survey.

You may also get quoted a different mortgage rate if you're applying for a non-conventional mortgage (e.g.; FHA loan, VA loan, USDA loan, jumbo loan), or if you're doing a home loan refinance.

Refinance mortgage rates are often slightly above purchase rates; while rates for FHA, VA, and USDA loans are often lower.

If you're shopping for a loan -- any loan -- you can expect the lowest mortgage rates since late-October. Pricing is at a 4-month best and is trending better since the New Year.

Click to see today's rates (Jan 18th, 2016)http://themortgagereports.com/18849/freddie-mac-mortgage-rates-below-4-percent-january-14-2016