Saudi Arabia faced resistance from Iran to proposals to restore a production target scrapped at OPEC’s last meeting in December as persistent divisions within the producer group undermined efforts to build unity.

Still, OPEC’s arch rivals adopted a more conciliatory tone in Vienna than in the past, with Riyadh promising not to flood the market and Tehran saying it was ready to listen to its counterpart. The diplomatic maneuvering is an attempt to mend divisions that had grown so wide many dubbed OPEC as good as dead and preserve the rebound in oil prices to about $50 a barrel.

“We will be very gentle in our approach, so we don’t shock the market in any way,” Saudi Arabia’s new oil minister, Khalid Al-Falih, said before he sat down with his counterparts in Vienna on Thursday. “We are satisfied with the price movement over the last few months and think it will continue to gently edge up without much intervention, assuming that more or less OPEC production stays where it is.”

The differences between Saudi Arabia and Iran echo the demise of a proposal to freeze production in April. Saudi Arabia made that deal contingent on the participation of Iran, which has insisted on its right to boost crude output to pre-sanctions levels. Kuwait also questioned the need for a production target, even as higher oil prices ease tensions within the group.

“A general quota for OPEC with no country quotas has no meaning,” Iranian Oil Minister Bijan Namdar Zanganeh said Thursday. “It’s not possible to control or supervise, and what it means is that anyone can do whatever they like and just say that it’s within the share.”

Zanganeh said a country-quota system might be difficult to achieve at today’s gathering.

Watch Al-Falih’s interview with Bloomberg’s Ryan Chilcote at the OPEC meeting in Vienna.

As ministers met in Vienna, Saudi Arabia, the organization’s largest oil exporter, was discussing ideas including restoring a production target, according to delegates familiar with the situation, asking not to be identified because the talks are private. Still, no formal proposal has yet been made.

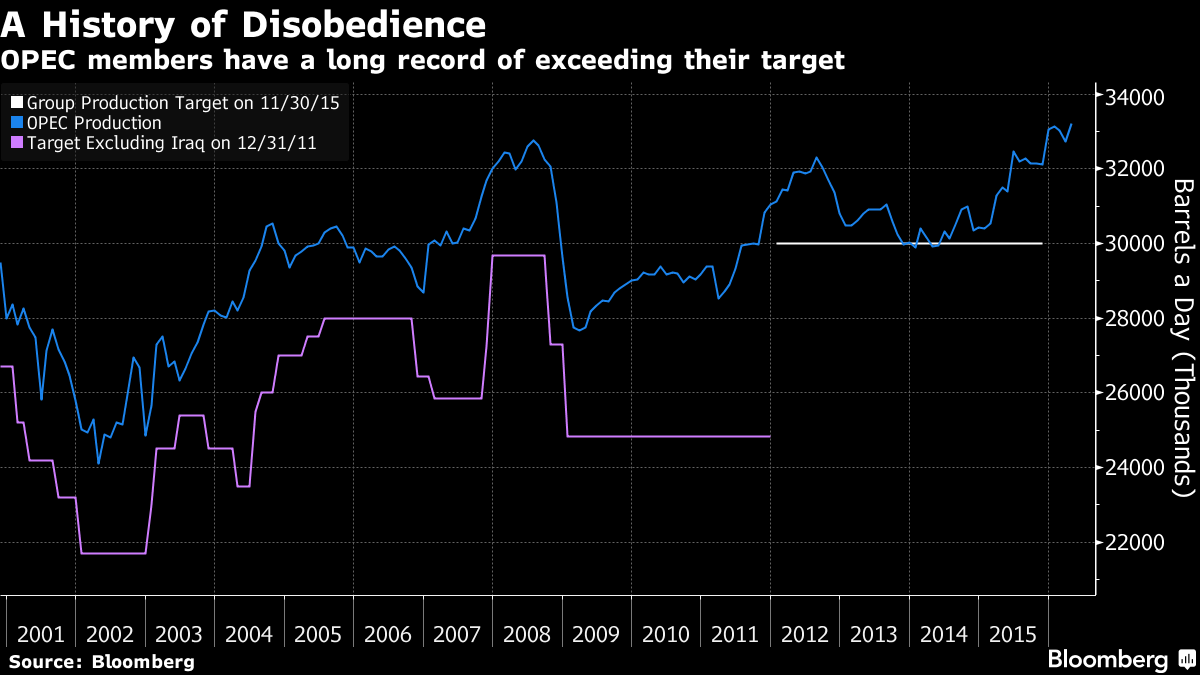

Ignoring Targets

"OPEC is still all over the place, but countries are groping for a way to send a signal of unity to the market,” said Bob McNally, chairman of the Rapidan Group, who is in Vienna observing the meeting.

"Contrary to market speculation, Saudi Arabia is open to cooperation," Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said in a report.

Oil fell 0.3 percent to $49.57 a barrel as of 1:36 p.m. in London on Thursday. Prices have rallied about 80 percent since January, when they slumped to the lowest in more than a decade.

Iran’s Stance

While Iraq and the United Arab Emirates, a key ally for Saudi Arabia, said they favored an output ceiling, another Gulf state, Kuwait, illustrated the divisions within OPEC.

"We are not talking about an output ceiling so far,” Kuwait Acting Oil Minister Anas Al-Saleh said on Thursday. “I don’t think we need to divert from a strategy that has been working well so far. And the ceiling is not the strategy."

Any deal will depend on Iran, which until now has rejected any cap on its production. Saudi Arabia and its allies have said in the past that Iran needs to participate in any deal. An April meeting in Qatar of oil producers from OPEC and beyond ended in a failure because Iran refused to sign up.

For a our OPEC live blog of today’s meeting, click here.

Despite the obstacles to a deal, Riyadh’s change of tone is striking and may reflect the desire of Al-Falih, who last month became Saudi Arabia’s first new oil minister in more than 20 years, to start his tenure with a successful meeting.

“I believe that the strategy that OPEC adopted in 2014 has indeed succeeded,” Al-Falih said on Thursday. “We see supply and demand converging.”

Introducing a ceiling would show that "OPEC is still important to the oil market," Gary Ross, chairman of PIRA Energy, a New York-based oil consultant, said. It would signal that "despite political differences, they can work together to achieve similar economic interests -- this is certainly a more positive outcome than the market expected," he said.

A deal would be a shock. Last month, only one of 27 analysts surveyed by Bloomberg said they expected an output target from OPEC’s meeting.

The conciliatory message from Saudi Arabia is an attempt to end a dark period for OPEC in which some analysts declared the organization effectively dead. In 2014, Saudi Arabia and its Gulf Arab allies decided to ditch production constraints in favor of a market-share strategy and prices crashed, bringing financial pain to many members and causing several rancorous meetings.

“There’s been too much emphasis on the divisions within the OPEC body,” Nigeria’s Minister of State for Petroleum Resources Emmanuel Ibe Kachikwu said on Thursday. “We’d like to finish this meeting feeling that we’re cohesive.”