Today’s Mortgage Rates Analysis

What's Impacting Today's Rates?

Today's mortgage rates are higher.

This morning, the ADP forecast for private sector job gains in October was 147K, below the consensus of 170K.

The Fed statement will come out at 2:00 et. No significant change in policy or in guidance is expected. No more economic data will be released today.

As a mortgage rate shopper, it's important to know when today's rates are changing. This is because, when mortgage rates change, mortgage lenders will not honor rate quotes which have not been previously "locked".

To lock today's mortgage rates, then, be sure to commit with your lender before current rates begin to move. Whether you're trying to lock a purchase or a refinance loan, the market waits for no one.

Click to see today's rates (Nov 2nd, 2016)Today's Mortgage Rates Analysis

Today's mortgage rate analysis is based on live mortgage-backed securities (MBS) pricing provided by MBSQuoteline, a real-time mortgage market data service available to loan officers, real estate agents, and other finance professionals.

The MBS data supplied by MBSQuoteline is the same market data used to formulate current mortgage rates by the nation's mortgage lenders.

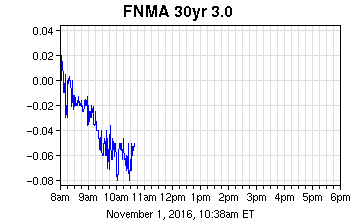

The chart at top depicts today's Fannie Mae mortgage bond pricing. Fannie Mae bonds are linked to conventional mortgage rates which include mortgage rates for programs such as the Home Affordable Refinance Program (HARP 2.0), the 3-percent down Conventional 97 loan, the HomePath mortgage program, and others.

MBS prices are inversely related to today's mortgage rates. When bond prices rise, mortgage rates sink. In general, a twenty-five basis point change in MBS pricing -- up or down -- leads to a 0.125 percentage point change in mortgage rates.

Note that the chart above does not depict the path of today's Ginnie Mae mortgage bonds, although Ginnie Mae bonds and Fannie Mae bonds tend to move in similar directions.

Ginnie Mae bonds correlate to today's mortgage rates for FHA loans, such as the FHA Streamline Refinance, which are insured by the Federal Housing Administration; VA loans guaranteed by the Department of Veterans Affairs; and USDA loans guaranteed by the U.S. Department of Agriculture.

What Are The Current Mortgage Rates?

Mortgage rates change all day, every day. The mortgage rates you get from your bank "now" won't be the same rates you get from your bank in an hour. Be smart when you shop. Compare multiple lenders and get your best deal.

Get today's real-time mortgage rates now. Your social security number is not required to get started, and all quotes come with instant access to your live credit scores.

Show Me Today's Rates (Nov 2nd, 2016)The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Try the Mortgage Calculator

Try the Mortgage Calculator