Everyone

knows that the 2008 Global Economic Collapse was caused primarily by

banks’ unregulated casino-style gambling. Instead of blackjack and

slots, the banks bet massively on financial derivatives known as a

“credit default swaps,” which Warren Buffett famously called

“weapons of financial mass destruction.”

Everyone

knows that the 2008 Global Economic Collapse was caused primarily by

banks’ unregulated casino-style gambling. Instead of blackjack and

slots, the banks bet massively on financial derivatives known as a

“credit default swaps,” which Warren Buffett famously called

“weapons of financial mass destruction.”

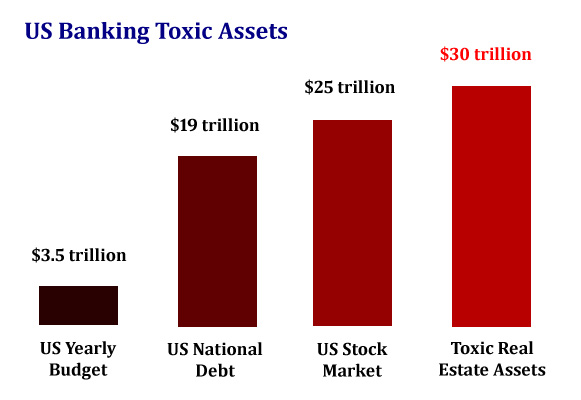

Now, Congress is enabling banks to once again use your deposited money to bet on these highly-risky derivatives. The criminal banks have already bet massively on these toxic swaps, to the tune of over $30 TRILLION – 8 times the budget of the United States Government and more than the entire value of the U.S. stock market!

And now that Congress has reopened the casino doors — and the banks can now use YOUR deposited money as bankroll — experts predict the coming explosion of financial WMDs will take down the global economy worse than we’ve ever seen. So you need to invest now in the ONE asset class that protects your savings & retirement against economic collapse.

Big Banks Once Again Gamble with YOUR Money

Credit default swaps are the unregulated derivatives that took down the global economy in 2008. They’re what Warren Buffet called financial WMDs – because they are as destructive as an atomic bomb. Regulations were put in place after 2008 to prevent banks from using your deposits in risky derivative trading, but now Congress has removed these regulations and given the green light to banks to gamble with your money once again!

Already, things are now MUCH worse than in 2008, despite Buffett’s warning. After YOU bailed out the banks and not a single banker was put in jail, the largely unregulated credit default swap market has grown to a staggering $30 TRILLION! And it’s about to get a whole lot bigger now that banks can get their paws on YOUR money. How much is $30 trillion? Take a look:

So what happens THIS TIME when $30 trillion in financial weapons of mass destruction blow up in the bankers’ faces? Well, one thing is for sure: Governments and central banks no longer have the bankroll to bail out the banks. So that only means one thing: Total collapse of the global banking system!

If you thought a 20-30% dip in your portfolio was bad after 2008, try an 80% collapse when the banking system completely falls apart! Or, the entire financial and banking system comes down like a house of cards. Total meltdown. And this time, The Fed and the U.S. Government won’t be there to prop up the stock market and recoup your gains after just a few years. THIS collapse could be deeper and longer-lasting than any we’ve seen before – even worse than the Great Depression!

Protect Yourself Now, Before It’s Too Late

Don’t fool yourself into believing you’re protected, or that you’re not personally invested in these financial weapons of mass destruction. Congress has made sure you ARE invested in these toxic derivatives. And just like in 2008, when the giant banks and other financial institutions collapse due to bad bets on credit default swaps, ANYONE invested in bank-issued paper investments will be taken down with the banks. This includes everyone from national governments to large institutions to average savers & investors.

So, how do you protect yourself when the entire system collapses? The answer: Do what Buffett did: Put a percentage of your savings, retirement & wealth in Gold & Silver – the #1 asset class that sits OUTSIDE of the financial system and in fact GROWS when paper assets fail.

Get Your FREE Gold & Silver Guide Now

And Gold & Silver have ZERO exposure to the credit default swap market. When Buffett saw the markets on the verge of collapse, he bought 4,000 tons of silver, weighing more than TEN Boeing 747s! Why? Because Gold & Silver have survived every fiat currency and every economy the world’s ever known and have been the wealth protector of choice for over 5,000 years.

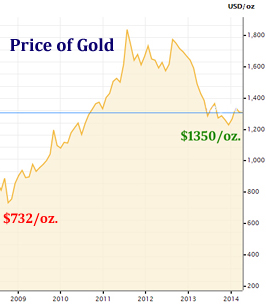

As evidence, Gold DOUBLED in the years after the financial collapse of 2008, while Silver increased over 5 times during the same period!

So remind yourself what it was like when Lehman Brothers and Bear Stearns collapsed and your entire portfolio took a nosedive after 2008. Are you willing to go through that and worse, knowing that the U.S. Government and the Fed no longer have enough money-printing ability to once again bail out the financial markets and prop up the stock market? Can you really endure an 80% loss of your savings, retirement or wealth?

....

https://www.wholesaledirectmetals.com/congress-empowers-banks-to-gamble-with-your-life-savings