Over the first eight months of this year, Spain averaged an impressive 47.2 percent renewable energy share in its generation mix.

The achievement was reported by Spanish electricity transmission system operator, Red Electrica de Espana (REE).

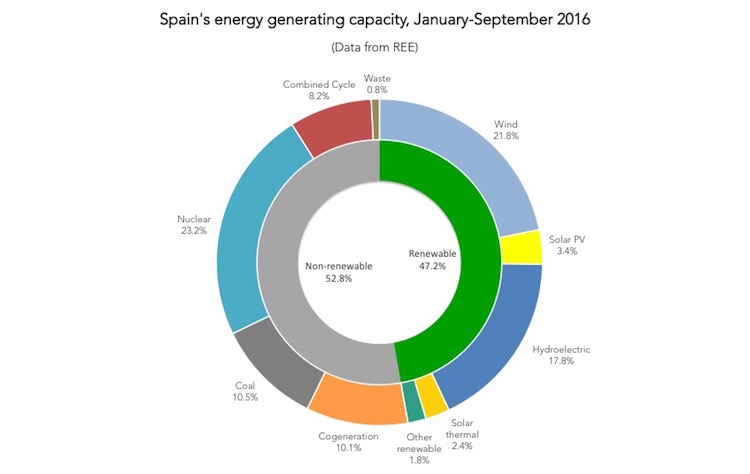

Breaking down the renewable share reveals Spain to have developed a strong mix of renewable generating capacity: wind power (21.8 percent), hydroelectric (17.8 percent), solar PV (3.4 percent), solar thermal (2.4 percent), other (1.8 percent). (See Figure 1.)

The remaining 52.8 percent of the generation mix was made up by a variety of non-renewables, including: nuclear power (23.2 percent) and coal (10.5 percent).

Demand over the same period on the Spanish peninsula from the population of 47 million was estimated at 167,133 GWh.

The top renewable source, wind power, generated 3,630 GWh, in the month of August — an increase of 12.2 percent over the previous year, and 17.6 percent of total production that month. For some time now, Spain has held the second highest wind power capacity in Europe — over 23 GW.

Figure 1

Still Waters Run Deep

Behind these impressive figures, however, the landscape of industry, policy and economics relating to renewable energy in Spain is somewhat more complex and challenged than it might first appear.

Renewable Energy World spoke with David Robinson, Senior Research Fellow at Oxford Institute for Energy Studies, on this matter. Before anything else, he observed that there are three key successes that should be acknowledged.

“The first success is that Spain has indeed achieved a very high penetration of renewables,” he said. “It’s gone much further than most countries.”

A key driver for this growth, a spokesperson at REE told Renewable Energy World, is European Union policy.

“We are also focusing on the safe integration of renewables, the development of initiatives aimed at energy efficiency and on incorporating innovative technologies to improve system efficiency,” the spokesperson said. “All this is geared towards achieving the new energy targets set by the European Council for 2030: 40 percent reduction of CO2 emissions with respect to the 1990 values; and 27 percent renewables share.”

Robinson said that Spain has been good at overcoming the challenges that come with operating a highly intermittent renewable system.

“Despite the fact that Spain is something of an electricity island (and is limited in the ability to export), it has been able to control intermittency quite well in several ways,” he said.

There are several aspects to this endeavor, he explained: “Spain has introduced policies giving renewable operators incentives that do not exist in many other European countries. One example is that they [renewable operators] face the same obligations and penalties if they don’t meet commitments to supply.”

In addition, he said, “they’ve allowed renewables to trade on the ancillaries services market.”

Essential in maintaining security of supply in the face of intermittency, is Spain’s Renewable Energy Control Centre (Cecre). Commenting on its significance, REE’s spokesperson said, “In order to integrate the maximum amount of generation from renewable energy sources into the electricity system, whilst ensuring quality levels and security of supply, in mid-2006 Red Eléctrica designed, put in place and started the operation of Cecre, a pioneering center of world reference regarding the monitoring and control of renewable energies.”

Cecre operates 24 hours a day, every day of the year, the spokesperson said. That allows for real-time analysis of the current scenario to be performed, and insight into the operational measures necessary for the system to remain in a safe state.

Robinson added that much of Spain’s progress has run in tandem with commendable “development of a highly successful industrial base for renewable energy, especially in the wind power sector.”

In spite of successes, it’s apparent that Spain is grappling with the challenges of transitioning to a renewable energy system. Several of these difficulties are synonymous with renewable energy, and are evident to varying degrees in other countries too; others, however, are idiosyncratic to Spain.

In either instance Spain’s circumstances serve as examples of challenges countries not as far advanced in deployment of renewables may one day face themselves.

“Several serious problems have emerged with Spain’s development of renewable energy,” Robinson said. “Top of that list is its tariff deficit.”

He explained: “For almost fifteen years, the Spanish electricity system has had a revenue — or tariff — deficit related to its regulated activities. It’s the result of setting regulated (grid) ‘access’ tariffs too low to recover all the recognized costs of regulated activities. These access tariffs cover not only transport and distribution network costs, but also other regulated costs and subsidies, including the support to renewable energy, which became the most important cost component of the electricity tariff.”

In addition to very generous remuneration, in particular to solar energy, Robinson added, “there was inadequate control over how much capacity was installed; especially with solar PV and CSP.”

A key example of this situation was a feed-in tariff that paid 450 euros/MWh for solar PV for 25 years that was granted in 2008. Though it was designed to incentivize 400 MW of solar PV, the framework didn’t include a capacity limit or cap on subsidies. With only an end date to the framework, projects amounting to more than 4,500 MW piled up.

But renewables are not the only reason for the tariff deficit. Bad tariff design, slow demand growth, absence of political will to undertake the necessary adjustments in the tariffs and other factors, contributed to the ever-increasing deficit, which was only halted through emergency interventions introduced between early 2012 and 2013.

“The situation has stabilized somewhat now, but the accumulated deficit currently still stands in the region of 25 billion euros,” Robinson said.

While the deficit remains a macroeconomic issue for the nation, importantly, its impact continues to exert significant influence over decisions concerning deployment of renewables.

“Because of the deficit and real anxiety about it increasing, and in the face of excess generating capacity, the government was very keen not to encourage any new capacity, especially if that new capacity meant any kind of guaranteed payments or subsidy,” Robinson said.

While government’s cautiousness has curtailed development from what it might have otherwise been, it casts uncertainty over what to expect for future growth for Spanish renewables.

Through 2015, no new wind power capacity was installed; and in 2014, only 27.5 MW was added — which the European Wind Energy Association reported as a result of “inadequate” policies.

Last year too, the Spanish government introduced the so-called “sun tax” — legislation that placed a levy on “self-consumption” of energy generated through solar PV systems. Highly contested, and contrary to ethos of emerging trend for empowering distributed renewable energy generation, it’s legislation that Robinson cannot see being maintained too far into the future.

The Role of Interconnection Capacity

As with many European countries, an important factor influencing growth of renewables in Spain is its capacity to import and export power. The latter is especially crucial for Spain, where generating capacity easily exceeds demand, depressing electricity prices and hampering renewable energy development.

Although Spain has had success in regulation of its electrical grid and high penetration of renewables, historically it has faced constraints in its transmission capacity with neighboring nations. These persist to the present where interconnection capacity is only around 4 percent of total installed capacity, according to the International Energy Agency’s 2015 national review.

Interconnection bottlenecks are “particularly apparent on the France-Spain border,” Robinson said, and “have led to renewables generation in Spain shutting down at times, although the curtailment has been limited.”

This situation is not ideal from a financial position for operators.

“Certainly one thing that would make a difference for renewable growth is potential to export,” he said.

A welcome development for renewable industries, work to expand transmission capacity has been relatively successful in recent years and has political support. Motivating further development, Spain is actively working towards meeting the European Council’s target of a 10 percent share of interconnection capacity in total installed generation capacity in every member country by 2020. However, this issue continues to be contentious due to the significant cost of expanding interconnection capacity.

Looking Forward

There are clear successes in Spain’s transition to sustainable energy production; all of which have contributed to the nation coming close to a 50 percent renewable share in its generation mix. But the circumstances are nuanced, and an outlook for the future is hard to gauge.

Commenting on his forecast for renewable energy growth, Robinson said that Spain is likely to continue with its build out, but there is uncertainty over whether there will be a need for another round of auctions.

If there is an auction, he said, “it is likely to include a range of technologies, including wind and solar PV. However, due to slow demand growth, it may be possible to meet binding 2020 targets without major investment. Furthermore, there were a lot of bidders at the last auction, which ended up in a price of zero; it is not clear whether future auctions will yield a positive price.”

Robinson also noted that 2030 renewable targets are currently non-binding on specific Member States, so investment in new renewable capacity before then will depend in large part on the economics of different renewables, on electricity demand and on government policies, which themselves depend on the which parties eventually form the new government.

For its part, REE is also cautious. Asked about the future landscape of energy production, REE’s spokesperson said, “It depends on the policies about renewable energy. Red Eléctrica integrates the maximum amount of generation from renewable energy sources into the electricity system, whilst ensuring quality levels and security of supply.”

Lead image credit: Gamesa.