Chip Process War Heats Up

Samsung and China are the wild cards

SAN JOSE, Calif. — Although volumes are still small, fully depleted silicon-on-insulator could grow rapidly in the wake of Globalfoundries’ plans for a 12nm process. Whether Samsung or a new fab coming up in Shanghai will adopt FD-SOI will be a big factor, said veteran market watcher Handel Jones of International Business Strategies.

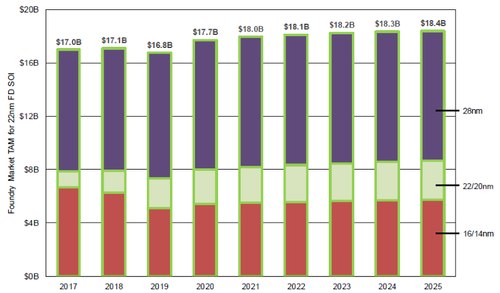

Ironically in a semiconductor industry traditionally focused on the next big thing, the aging 28nm node is likely to be the biggest process off all through 2025, according to the current IBS forecast.

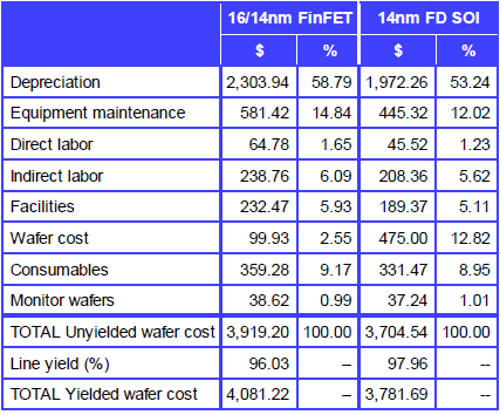

The FinFET processes adopted by top chip makers Intel, Samsung and TSMC provide the highest performance and lowest power consumption. However in a 14nm equivalent, FD-SOI supports 16.8% lower cost per gate than FinFETs, Jones said. It also provides about 25% lower design cost and risk of needing a re-spin, he added.

In addition, FD-SOI has a unique ability to dynamically manage power consumption through biasing. The process also delivers superior support for RF given a significantly higher cut-off frequency than FinFETs, said Jones who attended last week’s FD-SOI event in Shanghai.

“We think smartphone applications processors and modems could adopt 12nm FD-SOI as an alternative to 10nm and potentially 7nm FinFETs,” said Jones.

If the process is only available from Globalfoundries, Jones estimates it could grow to as much as a quarter of the advanced-node business. However, “if Samsung came in big time I could see market potential of 40-50% of the 14/16/10nm business covered by FD-SOI -- Samsung is the wild card,” he said.

China is another wild card, particularly a new fab in the works in Shanghai. Hua Li will get as much as $5.8 billion from the China government to build a new fab. It has not picked a process yet, but “there’s a reasonable possibility they will do FD-SOI,” said Jones.

Hua Li already runs about 30,000 wafers per month in an existing 300mm fab. It is part of the Hua Hong group that includes Grace Semiconductor which operates a 200mm fab.

SMIC, arguably China’s most advanced locally owned fab, is not likely to adopt FD-SOI. It is focused on ramping 28nm processes in high-k metal gate and polysilicon flavors. “They are making the right choice to be mainstream,” Jones said.

China could sustain “big losses” trying to compete with TSMC in the complex FinFET processes. Jones noted TSMC already as many as 500 engineers dedicated to FinFET design enablement.

Overall, “It’s a bit too early” to determine what share FinFET, FD-SOI and planar processes will take, said Jones who has estimated the total available market but not market share for FD-SOI