-

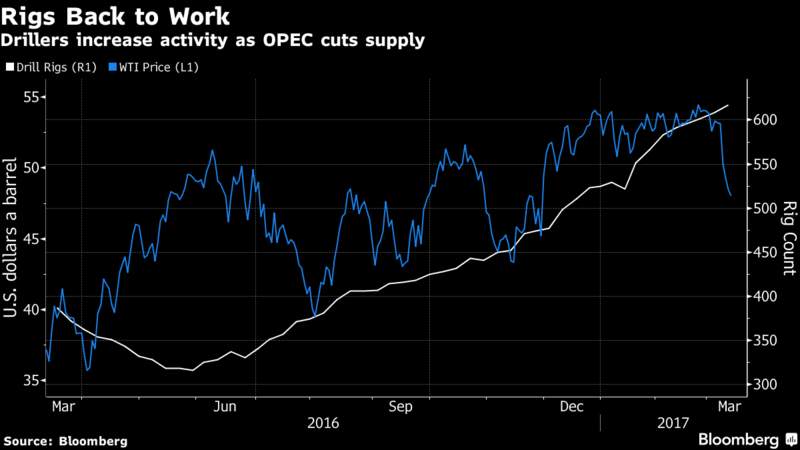

U.S. drillers boost rig count to highest since September 2015

-

Kuwait oil minister says he supports OPEC deal extension

Optimism Over OPEC Production Cuts Are Fading

Oil settles at the lowest level since November as record U.S. crude inventories and a boost in drilling activity threaten OPEC’s efforts to reduce a global glut.

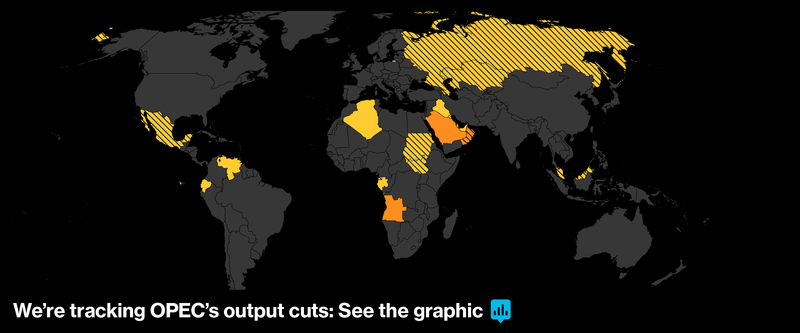

Futures slipped 0.2 percent in New York after fluctuating between slight gains and losses during the session. U.S. crude inventories probably rose by 3 million barrels last week, according to the median estimate in a Bloomberg survey before an Energy Information Administration report on Wednesday. Rigs targeting crude in the U.S. climbed to the highest since September 2015. Kuwait supports extending OPEC’s output deal beyond June, Kuwait’s official news agency Kuna reported, citing Oil Minister Issam Almarzooq.

Oil broke below the $50-a-barrel level last week that it had held above since the Organization of Petroleum Exporting Countries and 11 other nations started trimming supply on Jan. 1. OPEC Secretary-General Mohammad Barkindo said that February compliance to the historic deal will be higher than January and shale producers have agreed that oversupply isn’t good for anyone. Yet, U.S. crude stockpiles are at a record-high level and production surged to the highest in more than a year. Rising U.S. output is the “main threat” to the global output deal, according to Russia’s largest producer.

“It’s all about the short-term glut that we have to deal with today, with the potential shortage months down the road,” Phil Flynn, senior market analyst at Price Futures Group in Chicago, said by telephone. “For the market to establish the fact that it has finally hit bottom, we really have to get the price of oil back above $50 a barrel, which is still a tall order at this point.”

West Texas Intermediate for April delivery fell by 9 cents to settle at $48.40 a barrel on the New York Mercantile Exchange, the lowest since November 29. Total volume traded was about 7 percent above the 100-day average.

Shale Surge

Brent for May settlement declined 2 cents to end the session at $51.35 a barrel on the London-based ICE Futures Europe exchange. The benchmark traded at a $2.41 premium to May WTI.

The EIA sees output at major U.S. shale plays reaching 4.96 million barrels a day in April, the highest since March 2016, according to a report released on Monday. U.S. drillers boosted the rig count by eight to 617 last week, according to data from Baker Hughes Inc. on Friday. The nation’s crude output has climbed to 9.09 million barrels a day, according to data from the EIA.

Cushing, Oklahoma supplies increased by 1.3 million barrels last week, according to a forecast compiled by Bloomberg.

“What $50 proved, was anything $50 or north of $50 a barrel, will lead to expanding rig counts and higher U.S. production,” Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, said by telephone. “If your goal is to stop growth in U.S. production, you’ve got to have a lower price.”

Oil-market news:

- In Libya, crude production dropped 13 percent as clashes among rival armed groups led to the closure of some of the OPEC nation’s biggest oil-export terminals.

- VelocityShares 3X Long Crude ETN saw a record $194.6 million inflow last week, data shows, while investors poured about $80 million into the U.S. Oil Fund.

- Investors should go or stay long on WTI crude and copper, Goldman Sachs Group Inc. analysts including Jeffrey Currie wrote in a report.