-

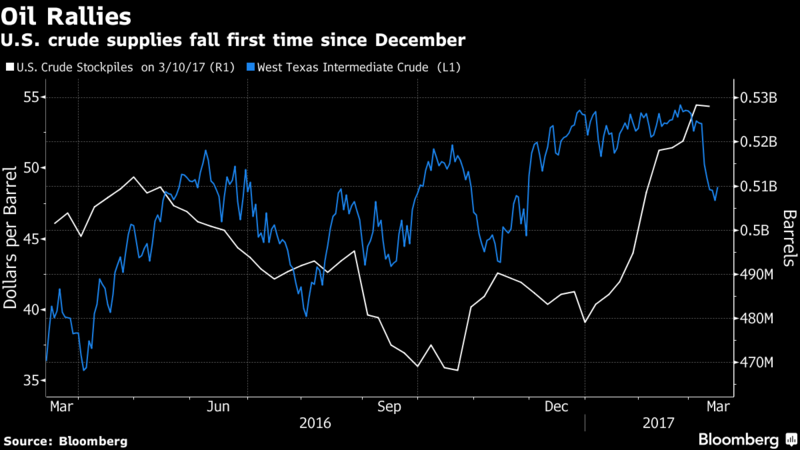

U.S. stockpiles decline by 237,000 barrels last week

-

The Federal Reserve raises its benchmark lending rate

Saudi Arabia Tells OPEC Production Rose in February

Oil advanced after a government report showed U.S. crude stockpiles unexpectedly declined last week.

Futures rose 2.4 percent in New York, the biggest gain since January. U.S. crude inventories fell by 237,000 barrels last week, according to an Energy Information Administration report on Wednesday. That’s the first weekly decline since December. A Bloomberg survey had forecast a gain in stockpiles, while the industry-funded American Petroleum Institute was said to report supplies dropped last week. The Federal Reserve raised its benchmark lending rate a quarter point and the dollar weakened.

Oil last week broke below $50 a barrel for the first time since December as rising U.S. supply counteracted reductions by the members of the Organization of Petroleum Exporting Countries and 11 other nations as part of a deal to help re-balance the market. While an OPEC report Tuesday showed Saudi Arabia’s production climbed back above 10 million barrels a day in February, output still remains below a ceiling set under the six-month cut deal.

The EIA report was “very supportive. These numbers are very closely aligned with the API numbers yesterday,” Michael Loewen, a commodities strategist at Scotiabank in Toronto, said by telephone. “This happened a lot sooner than most of us were expecting, the crude oil draw, which was mostly due to net imports being substantially lower.”

West Texas Intermediate for April delivery rose by $1.14 to settle at $48.86 a barrel on the New York Mercantile Exchange. Total volume traded was about 35 percent above the 100-day average.

Clearing Supply

Brent for May settlement advanced 89 cents to end the session at $51.81 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $2.43 to May WTI.

The dollar declined as the Federal Reserve raised its benchmark lending rate a quarter point and projected two more increases this year. A weaker greenback boosts the appeal of dollar-denominated commodities as an investment. The Bloomberg Dollar Spot Index, a gauge of the currency against 10 major peers, fell 1.3 percent.

“Rates are going up because the economy is getting better. That means demand is also going to be higher, too,” Carl Larry, principal consultant for Oil Outlooks and Opinions LLC in Houston, said by telephone. “So, once refineries start picking back up, we’re going to see a lot better demand and oil prices should be supported, at least in the next month or two.”

U.S. crude inventories declined to 528.2 million barrels last week, data from the EIA showed. Crude imports fell by 745,000 barrels a day to 7.41 million. Gasoline supplies dropped by 3.06 million barrels to 246.3 million, the lowest level since January. Inventories of distillate fuel slipped 4.23 million to 157.3 million.

Output rose for a fourth week, advancing 21,000 barrels a day to 9.11 million, the highest level since February 2016 and stockpiles at Cushing, Oklahoma, the biggest U.S. storage hub and the delivery point for WTI, rose by 2.13 million barrels to 66.5 million.

Refinery utilization declined last week to 85.1 percent from 85.9 percent, as plants conduct seasonal maintenance programs.

Global oil markets are still struggling to clear a surge in supply from OPEC at the end of last year, according to an International Energy Agency report on Wednesday. Oil stockpiles across developed nations increased in January for the first time in six months after OPEC nations “relentlessly” raised production while finalizing an agreement to cut output. While the producer group is now implementing more than 90 percent of the pledged curbs, the IEA predicted a smaller drop in inventories during the first half amid a weaker assessment of demand growth.

Oil-market news:

- Iraq pumped 4.57 million barrels a day of oil in February. The country plans to increase output to 5 million barrels a day by the end of 2017, Oil Minister Jabbar Al-Luaibi said Wednesday at a news conference.

- OPEC’s output cuts aimed at easing a global glut are “real” and are cleaning up the market, Citigroup Inc. analysts including Seth Kleinman wrote in a report dated March 14.

- Oil will have to drop to the $30s or lower to dent the bottom line of many drillers now working U.S. shale fields, said Katherine Richard, the CEO of Warwick Energy Investment Group, which own stakes in more than 5,000 oil and natural gas wells.

©2017 Bloomberg L.P. All Rights Reserved

https://www.bloomberg.com/news/articles/2017-03-14/oil-gains-as-api-said-to-report-u-s-crude-stockpiles-decrease